When it comes to cryptocurrencies, the Chinese government’s stance is obvious: they are unnecessary and unwanted in the country. The government under President Xi Jinping has taken multiple steps, including the banning of cryptos and ICOs and any news outlets reporting on them, in order to ensure their death in the country altogether.

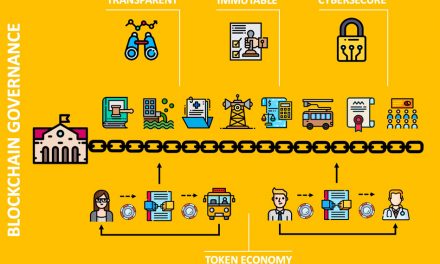

However, blockchain (which was essentially introduced as the foundation of cryptocurrencies) is looked at in a much more positive light, being the one that Jinping believes will have “breakthrough” applications in the future.

The head of 500 Startups’ China unit, Edith Yeung, describes China’s interest in blockchain as a “love-hate relationship,” — love for blockchain, but hate for the cryptocurrencies that the blockchain was initially introduced for.

Although China may not have a future with cryptocurrencies, the country is quickly taking huge strides in terms of blockchain technology, which places China at the forefront in the race for blockchain advancement.

China’s Exploding Blockchain Industry

At the end of 2017, more than 320 blockchain companies were operating in the Chinese market. That number has increased up to 4,000 companies in 2018. In comparison, there are a little over 800 blockchain companies operating in the US and only about 340 in the UK.

What could have caused such a significant rise in such a short amount of time? Increased funding. Nanjing City launched a $1.5 billion blockchain fund in 2018 for blockchain technology-related companies. With government support, it’s expected that blockchain can improve healthcare, logistics, supply chain management, urban planning, food safety and various other sectors, so let’s take a look at some of the companies that using it now.

Alibaba

With over 90 blockchain-based patents to its name, Alibaba has positioned itself as the global leader of blockchain technology. The company began offering Blockchain as a Service (BaaS), through Alibaba Cloud at the beginning of 2018, eventually expanding it for use beyond its domestic markets in October the same year.

Its subsidiaries Lynx and T-Mall are already using blockchain through the tracking of cross-border logistics services. For example, T-Mall has implemented these features through its shipments to over 50 countries. For the companies, blockchain has proved valuable in all aspects, from shipping to customs.

Alibaba has even expressed interest in improving healthcare and food history in the country. The company’s strategy is simple. By using blockchain in hand with the Internet of Things (IoT) and artificial intelligence (AI), they plan to be the future leader in technology across the globe.

Chinese Banks Using Blockchain

Unlike Bank of America, which holds the most banking-related blockchain patents but hasn’t yet implemented any, multiple banks in China are actually putting their patents to use.

The largest bank in China, Industrial and Commercial Bank of China (ICBC) uses blockchain for digital credit financing. China Construction Bank Corporation (CCBC) recently launched China’s first domestic blockchain-based letter of credit (LC). Additionally, the Agricultural Bank of China (ABC) issued a $300,000 loan using blockchain. The reason why China and blockchain seem to go hand in hand is that instead of just holding on to patents, local organizations immediately implement them into their systems.

Increasing Awareness

China is home to a substantial amount of blockchain-related conferences. It is at these conferences that the newest blockchain advances are announced in the country.

There is the iBlockchain Summit in Shenzhen, the World Blockchain Technology Forum in Beijing, the Blockchain Practitioner Conference in Shanghai, and many others intended to push blockchain awareness in the country and worldwide. Now that blockchain companies are expanding further, 2019 is bound to be a historic year for the industry, undoubtedly filled with blockchain-focused conferences throughout China and across the world.

Goodbye Bitcoin China, Hello Blockchain China

Although bitcoin and other cryptocurrencies have been banned from trading in China’s domestic markets, blockchain’s uses continue to grow. Through increased government funding, and blockchain’s diversification in uses by companies like Alibaba, as well as banks such as ICBC, CCBC and ABC, China only increases its lead in blockchain technology.

It is expected that the blockchain market size will reach over $7 billion by 2024.

If China continues its advancement while other countries continue to lag behind, we can expect China to hold most of those profits.

Blockchain Insights

Join our mailing list to receive OpenLedger Insights publications weekly.

Thanks! Please check your inbox to verify your email address.

By clicking “Subscribe”, you’re accepting to receive newsletter emails from OpenLedger Insights every week. You can easily update your email or unsubscribe from our mailing list at any time. You can find more details in our Privacy Policy.