On November 30, the Belarusian Hi-Tech Park released new regulations on blockchain and crypto operations compiled in cooperation with the National Bank, state agencies and international experts. A week later, the business community is still buzzing, trying to make sense of the new rules and their impact on the state of blockchain technologies in the country – and beyond it.

It’s not the first attempt at regulating the blockchain and crypto market in the country. On December 21, 2017, the Belarusian government passed Decree No. 8 “On Digital Economy Development.” It became the country’s first official law to define the legal status of blockchain, tokens, mining, and smart contracts.

Almost a year later, the Decree was complemented with more details. This time, on November 30, the Supervisory Council of the Hi-Tech Park approved a string of new descriptive documents on the regulation of token-related activities.

It’s not surprising the regulations are coming that way – the Hi-Tech Park is the only authority of this kind in Belarus, serving as both a tech hub and regulatory body. It is the one to regulate all blockchain and cryptocurrency companies, both local and foreign, operating in Belarus. This means, in turn, that such companies are obliged to become the Park’s residents to be allowed any token-related operations.

While the new regulations are heavy on the cryptocurrency side, there is one particular area that is vital for blockchain startups. That is ICO regulations, and we’re going to take a closer look at them.

ICO Regulations: The Stepping Stone

As explained by Viktor Prokopenya, one of the leading VC investors and IT experts in Belarus, the regulations mark a crucial milestone in that they legalize token release and distribution for business funding purposes.

The regulations define transacting parties as ICO clients, ICO organizers, and investors. No need to say, only residents of the Hi-Tech Park can become ICO organizers. The detailed requirements on the application procedure, both for domestic and foreign businesses, can be found here (in English).

In the document outlining the requirements to ICO services, these are the major points covered:

Requirements to the client company: Those can be only legal entities, either Belarusian or foreign ones, with the key executive roles onboard (such as a director, a chief accountant, and a chief risk manager, among others). Business reputation is listed as a major requirement as well, and the clients are asked to prove their compliance with written evidence.

Contract terms: The document lists all the permitted types of ICO services that fall under the regulations, including escrow, risk management, and marketing services, and the required contract provisions to protect both parties’ interests.

Smart contract audit: A central mechanism to token release and distribution, smart contracts must be audited and validated in terms of their security, reliability and risk-free performance. Such smart contracts may include those created by third parties, yet they will have to go together with a detailed audit report.

Token advertising: The key focus of regulating token promotion here is to ensure ads inform investors to the maximum extent, clearly stating possible risks and terms of token ownership. Under the rule, each token advertisement should be verified in written by the ICO organizer’s compliance officer in charge.

Investor communications: White papers, token ownership agreement terms, and risks all should be clearly communicated to potential and actual investors. The document also lists the must-have components of the white paper.

Cybersecurity standards: Under the regulations, ICO organizers can provide ICO services only to those clients who have ensured their business operations comply with information security practices, and can prove such compliance in writing. This should be reinforced with regular cybersecurity reports sent to the ICO organizer.

ICO organizers’ internal control: Hi-Tech Park residents rendering ICO services must go through stringent internal security and AML control checks. The full list of internal control regulations can be found here.

Sure, the scope of these regulations goes far beyond ICO projects. Let’s take a look at a bigger picture to see what makes them stand out in the world’s legislative domain.

What Makes It Progressive?

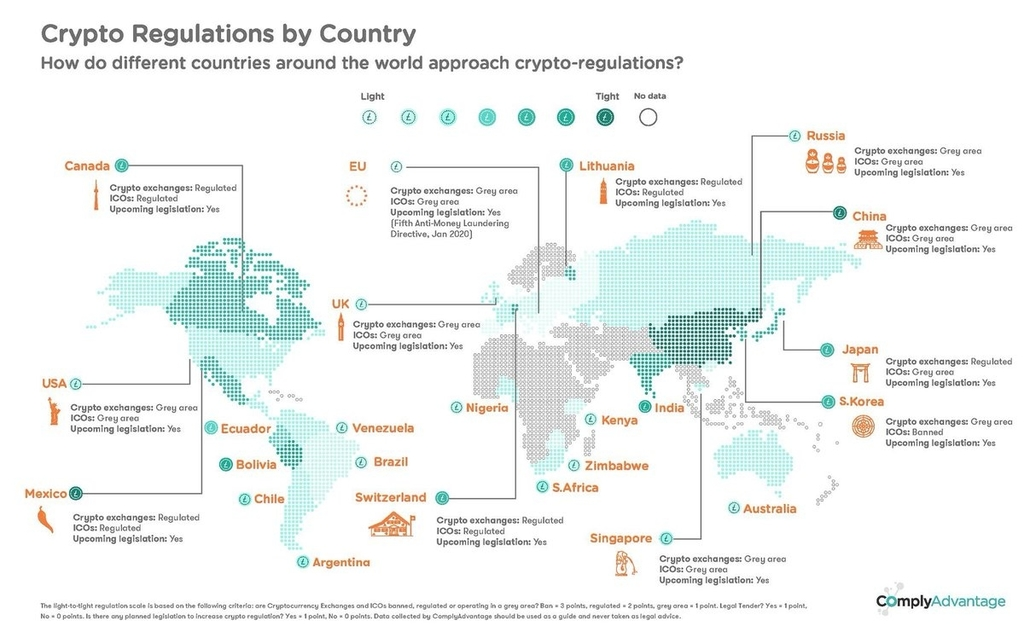

With this second round of regulations, Belarus is aiming to become the world’s leader in blockchain and crypto legislation. What sets it apart from others is that Belarus has recognized the specifics of blockchain-driven decentralization behind cryptocurrency operations. This way, showing up as a role model for other countries, Belarus is poised to bring clarity to this emerging domain that is yet to mature.

It’s also notable that the law prioritizes security and audit validation, making Anti Money Laundering, information security and protection of investor rights central. Under the law, the companies willing to operate in the blockchain and cryptocurrency domains must pass audit by one of the ‘big four’ auditing companies – E&Y, Pwc, Deloitte, or KMPG.

The new Hi-Tech Park regulations also serve as a legislative foundation that incorporates the best practices of international law, especially where it concerns data privacy. Here, certain provisions were based on MiFIDII (EU Markets in Financial Instruments Directive) and GDPR as guidelines.

Already recognized among the top 10 blockchain-friendly jurisdictions back in May, now Belarus has made one more big step opening toward the global digital economy.

Experts such as Martin Hess are commenting on the innovative regulations, viewing them as prerequisites for forming a fully legal operational framework for blockchain and crypto businesses, along with other countries like the USA, Malta, China and Switzerland.

Martin Hess, Partner, Wenger & Vieli:

Belarus has drafted a stand-alone, comprehensive regulation for digital assets. Cryptocurrency regulation is the future, because only regulation provides legal certainty. The distributed consensus provided by algorithms is not sufficient. The Belarus approach has the

benefit of speed and simplicity, because it does not require an understanding of the whole

Belarusian legislation, court and legal practice in order to start a business.It remains to be seen how the standalone Belarus regulations will be interpreted and applied. The Belarus regulations will also be assessed in comparison to the relevant legislation for digital assets in other countries. Today, it’s important to ensure that the Regulations, their application and interpretation as well as their amendments and developments are equivalent to the legislation of other important jurisdictions such as US, China, European Union, Japan, Korea, Singapore and Switzerland.

For more details, follow these links for the full texts of the regulations and the expert summary.

Blockchain Insights

Join our mailing list to receive OpenLedger Insights publications weekly.

Thanks! Please check your inbox to verify your email address.

By clicking “Subscribe”, you’re accepting to receive newsletter emails from OpenLedger Insights every week. You can easily update your email or unsubscribe from our mailing list at any time. You can find more details in our Privacy Policy.